There is so much information being published by the IRS, SBA, and local government officials about Covid-19-related funding and loan forgiveness, that it can be really challenging for business owners to keep up with it all.

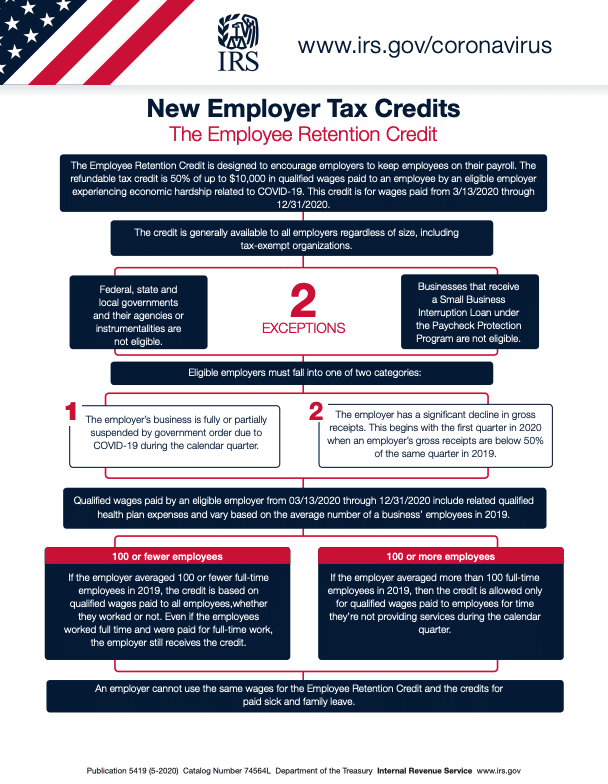

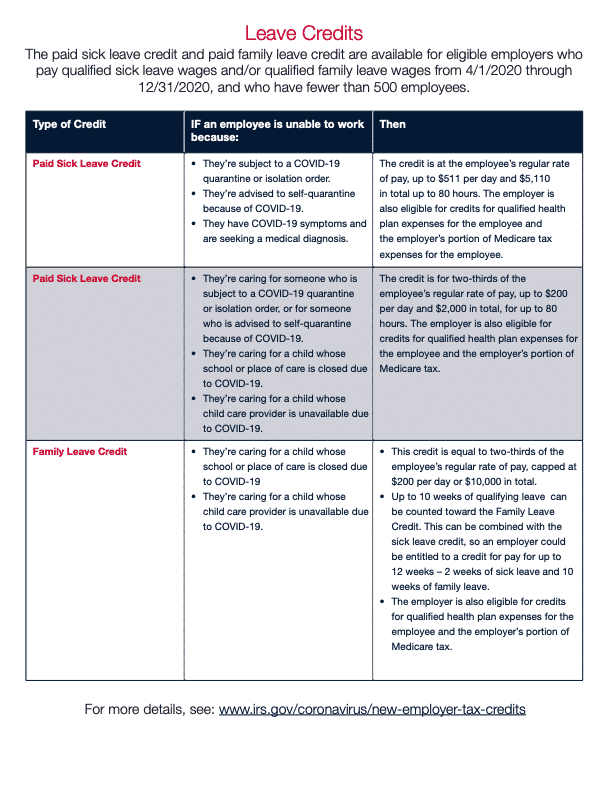

In June 2020, the IRS issued Publication 5419, New Employer Tax Credits to help employers understand the tax credits available to them due to the coronavirus pandemic. It breaks down the details of the Employer Retention Credit and the credits for paid sick and family leave in easy-to-follow charts. Using this, employers can determine whether they are eligible for the credits, the amount of the credits, and which wages apply to the credits. For more information about the New Employee Tax Credits, go here.

We know that these are crazy and challenging times for most business owners, and our highly-trained team of payroll specialists are here to help. At Benchmark, we partner with Paychex and other national payroll companies to process and accurately track your payroll expenses. If you need help tracking payroll, sick leave, and family leave so that you can take advantage of these tax credits, please give us a call.

As always, we recommend you speak with your accountant to ensure you are taking advantage of all available employer tax credits when filing your business tax returns.

Leave A Comment